Stores on TaxWisp Paid Plan

This is the store guide designed for Shopify stores on TaxWisp Paid Plan. Please refer to the Installation Guide if you have not configured and enabled TaxWisp already on your store. This guide will walk you through accessing and using the TaxWisp app from your Shopify admin portal, setting up the app, and handling tax exemption management for your store. App acitivities include receiving tax exemption requests from customers, validating these requests, approving or rejecting them, revoking exemptions, and tracking the status of tax exemption requests. Now it's time to use the app to manage your store's tax exemptions seamlessly.

Getting Started

You have installed the TaxWisp already following the on-screen instructions. After installation, go to the TaxWisp app from your Shopify admin portal and pin the app to your navigation to make it easily accessible.

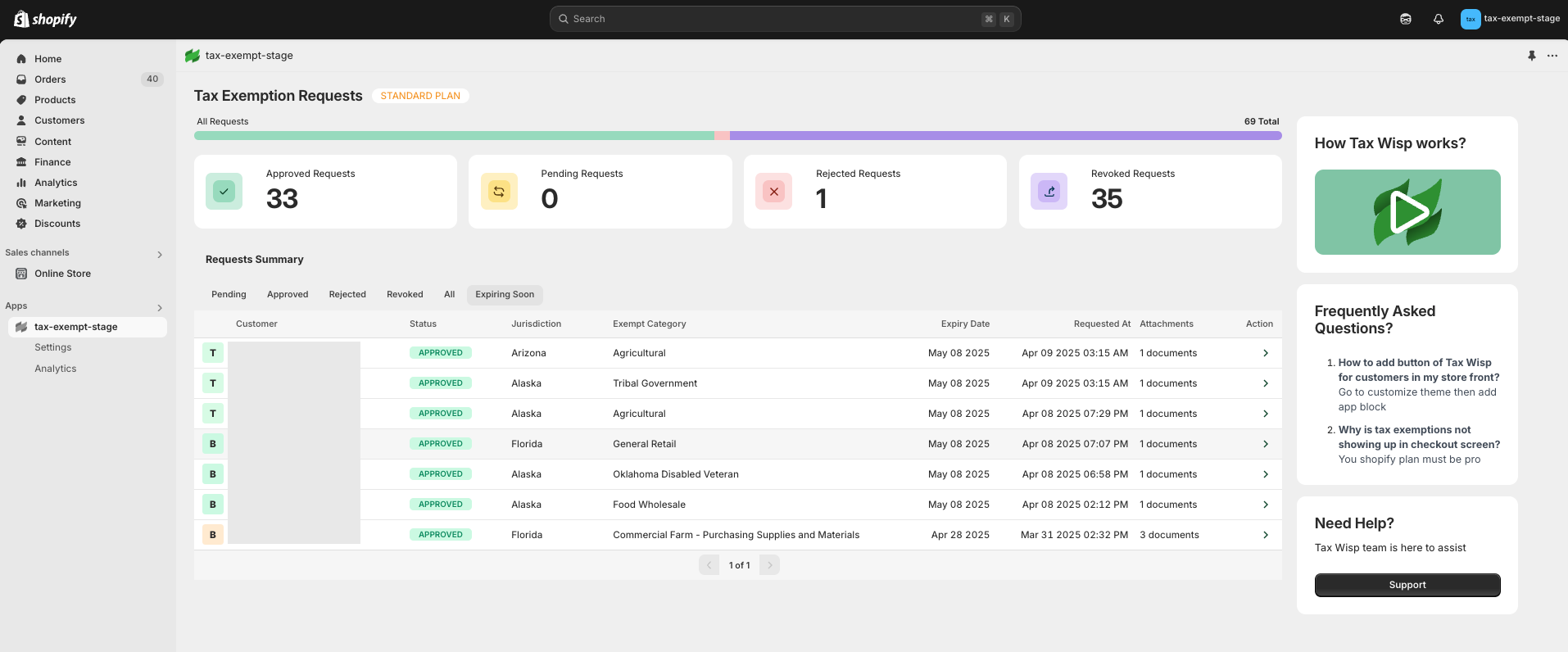

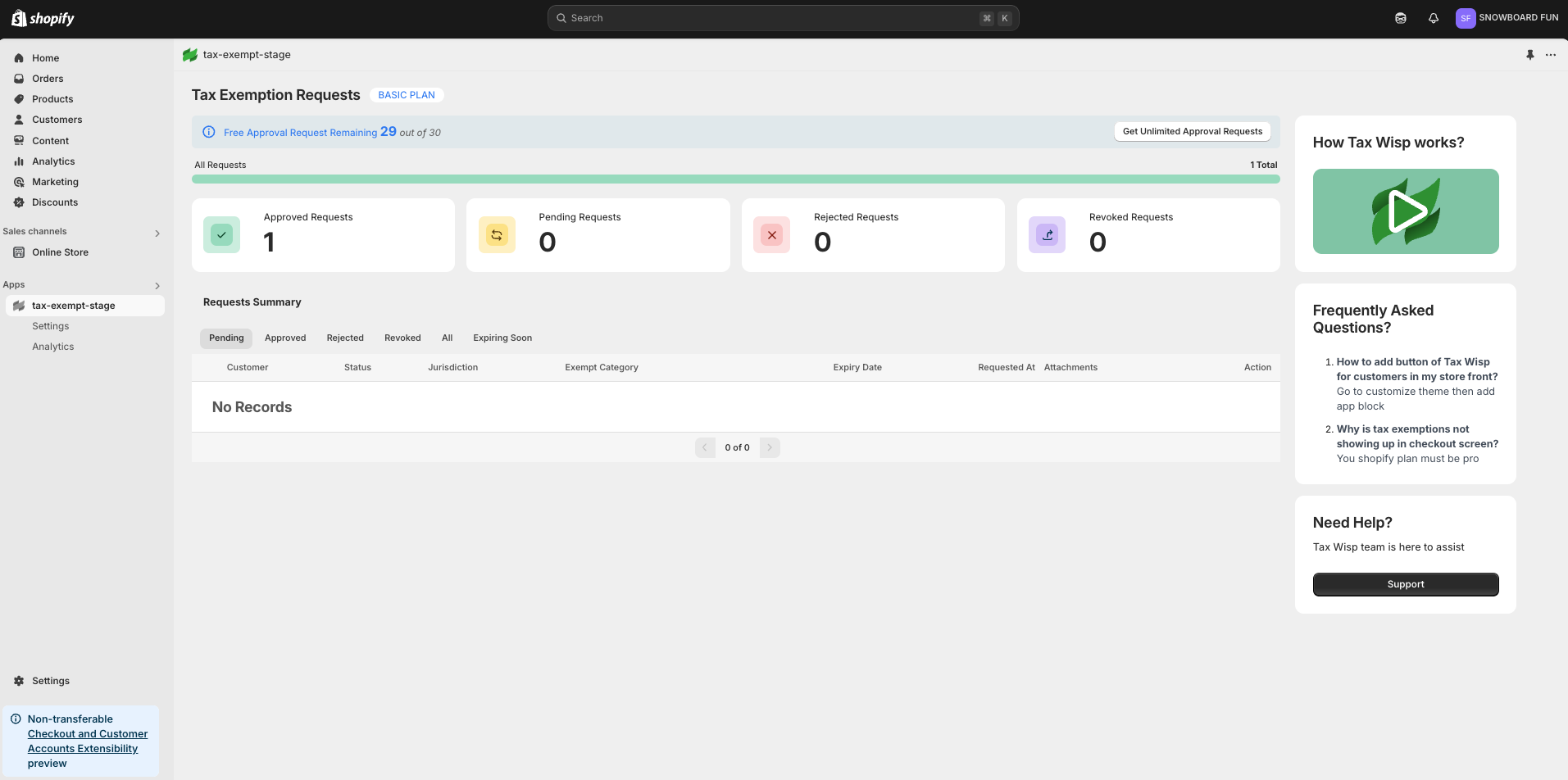

Accessing the App Dashboard

-

Log in to your Shopify admin panel.

-

Navigate to the "Apps" section and click on the TaxWisp app to access its dashboard.

-

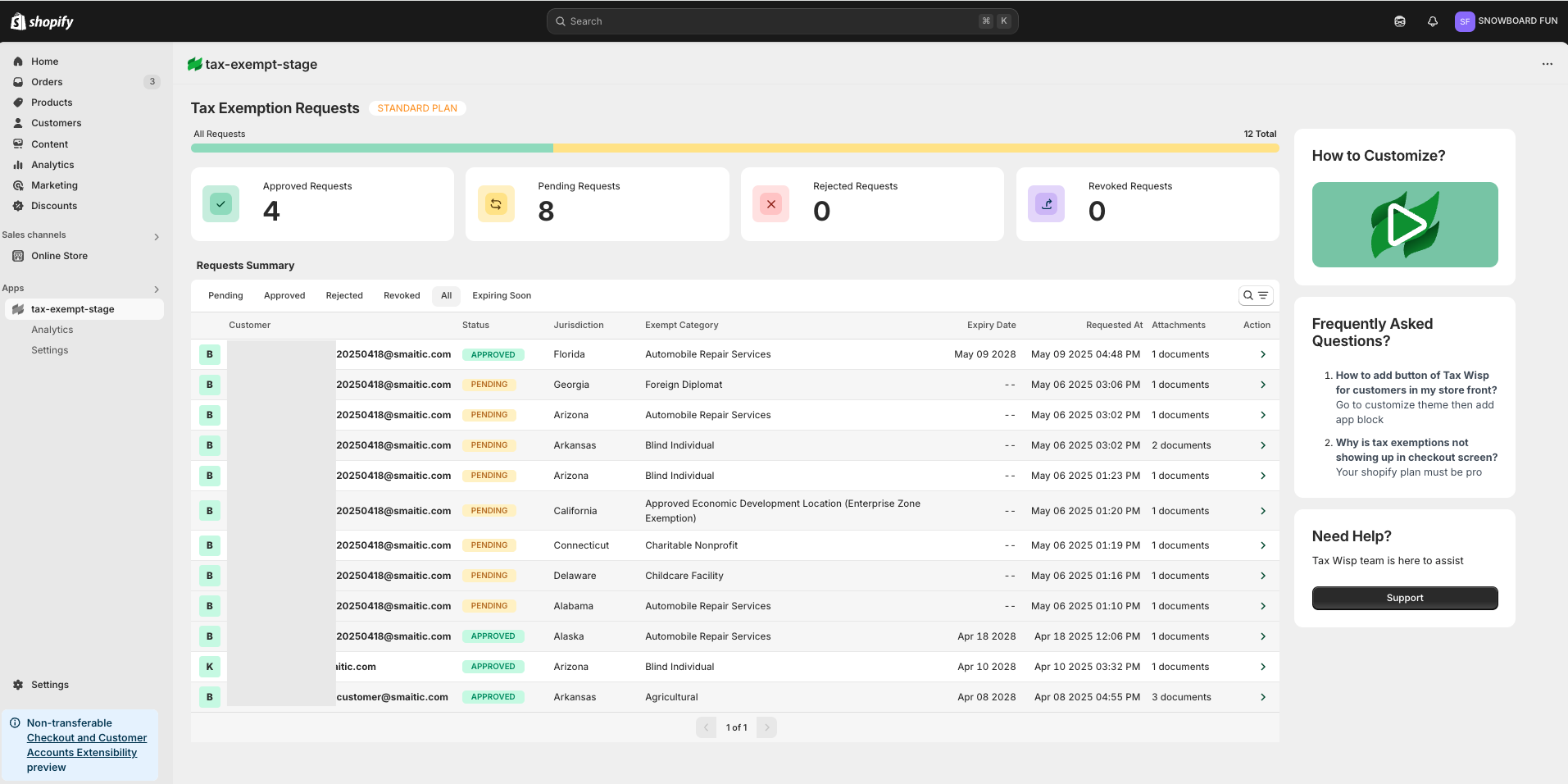

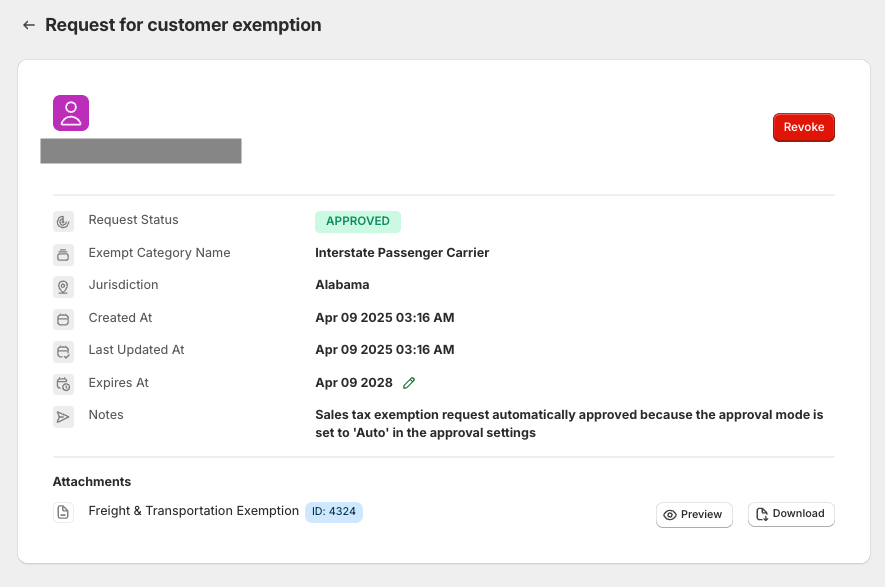

The dashboard contains the following information:

-

Count of Total Requests, Approved Requests, Pending Requests, Rejected Requests, Revoked Requests and requests that are Expiring Soon.

-

Summary of latest exemption requests.

-

Managing the Tax Exemptions

Manage the tax exemption requests and statuses for customer’s tax exemptions. Please note that the store can only exempt taxes from a specific jurisdiction if they have a store presence within that jurisdiction.

Receiving Tax Exemption Requests

- Customers will request tax exemptions during their checkout process. Explore the Customer Guide to understand how the customer experiences TaxWisp in checkout process.

- When a request is made, the exemption request is visible on the TaxWisp dashboard and you will also receive an automated notification via email.

Auto-Approval Setting for Tax Exemption Requests

-

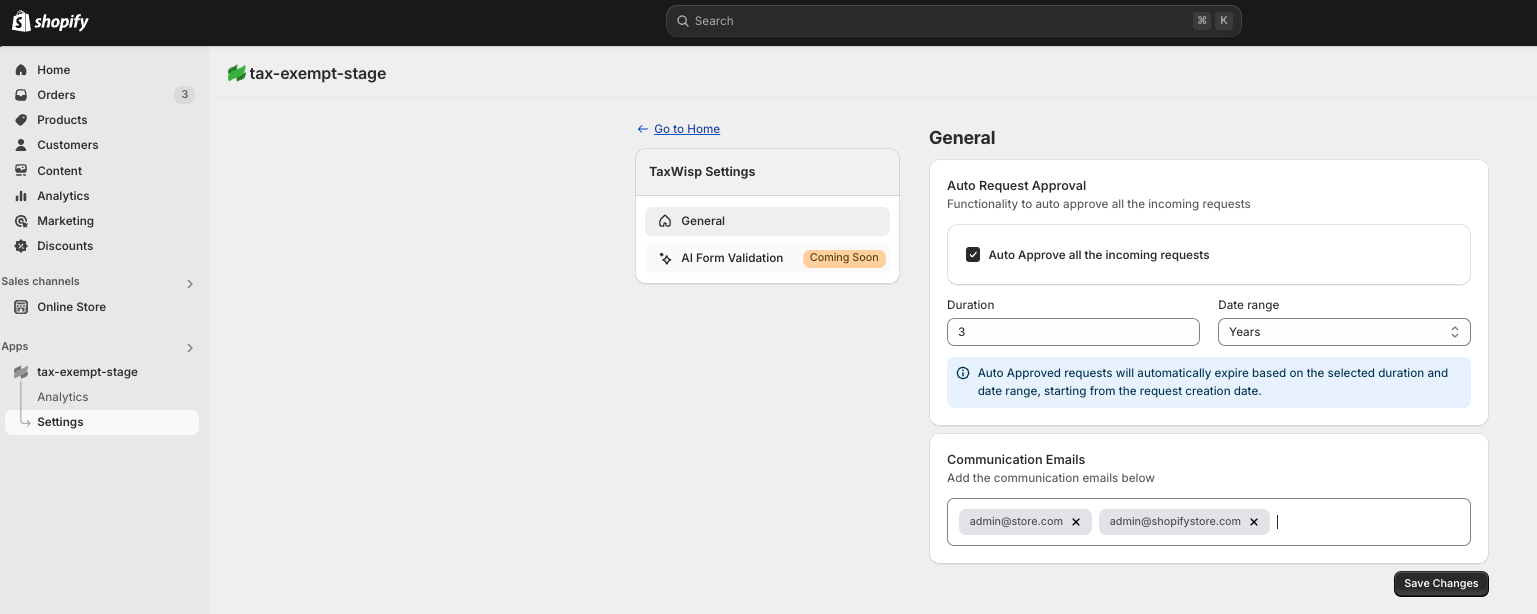

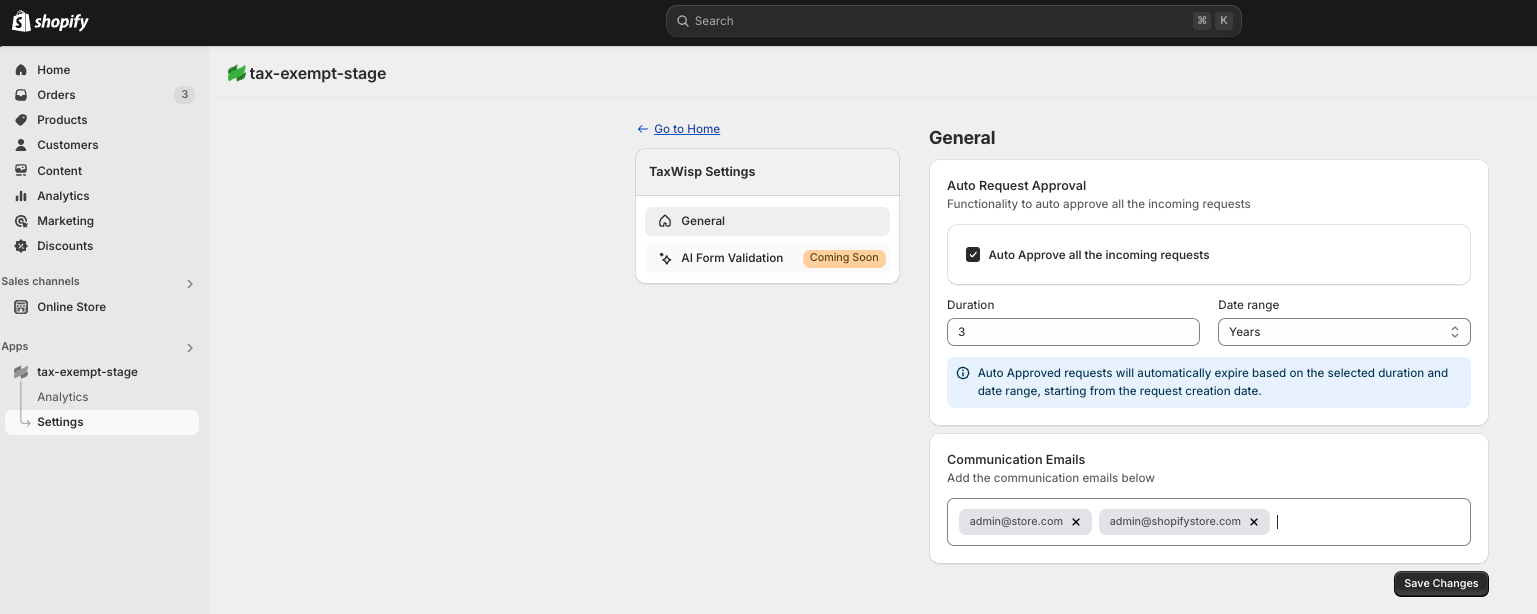

Stores can utilize Auto-Approval Setting for enabling auto approval of customer tax exemption requests, allowing to decide whether tax exemption requests should be automatically approved or should go through manual approval process once submitted by customers.

-

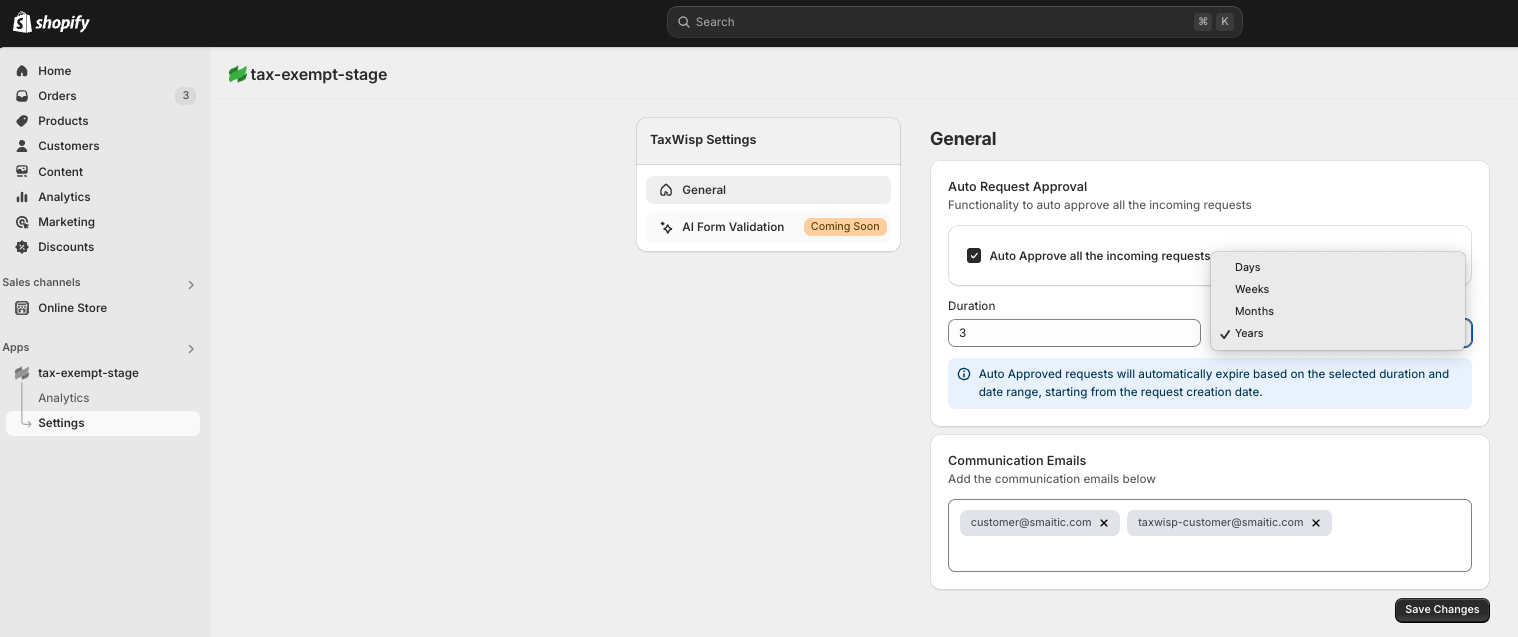

When Auto-Approval is enabled, requests submitted by customers, along with their uploaded exemption certificates and documents, will bypass manual review and be instantly approved. Stores should specify a duration for the auto-approval validity—to be specified as days, weeks, months, or years—to automatically reset or require re-validation of exemption requests after the selected time period.

-

When Auto-Approval is disabled, all requests will require manual review and approval.

Setting Emails for Notifications

TaxWisp sends email notifications to stores for key tax exemption events—such as new exemption requests, approvals, expirations, and more. By default, these notifications are sent to the store admin email configured in your Shopify account.

However, you can customize your email preferences within the TaxWisp app:

- Add Additional Email Addresses to receive tax exemption-related updates.

- Change the Default Email Address if you'd prefer notifications to go elsewhere.

This ensures that the right people on your team stay informed and never miss an important update in the exemption process.

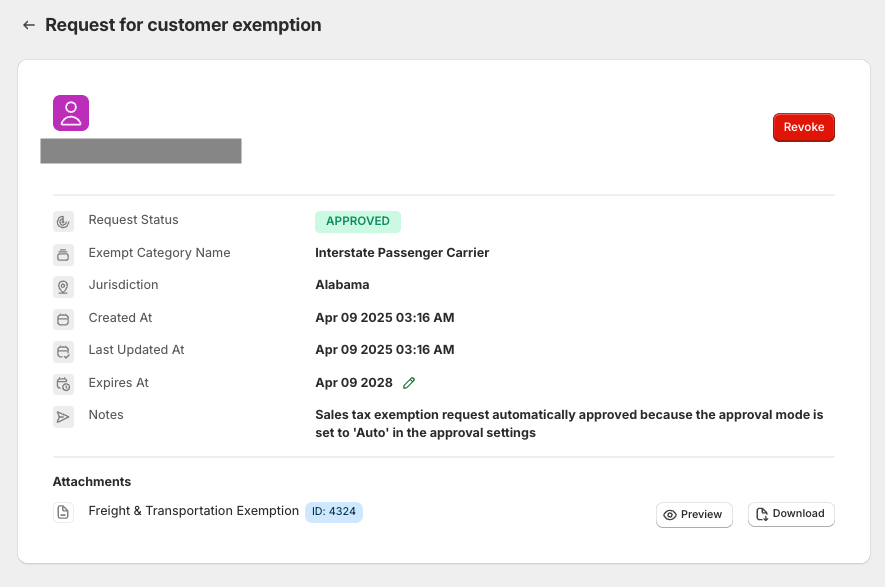

Validating Tax Exemption Requests

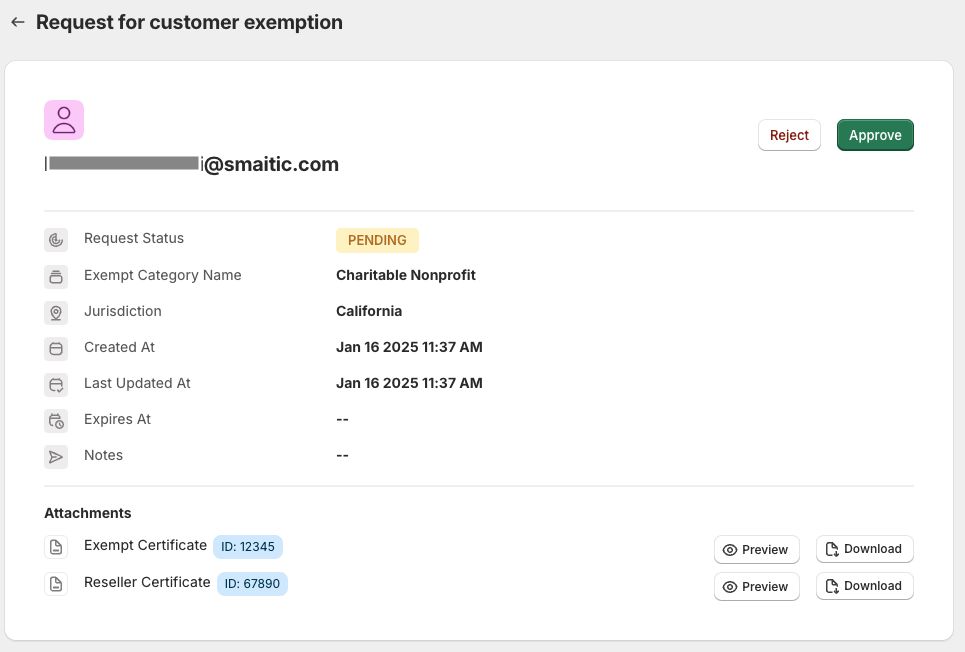

- Access the requests from app dashboard.

- Click on each request to view the customer's tax exemption request, exempt category, associated certificates and any additional information provided.

- Ensure the exemption category is correct, certificates are valid and meet the requirements of the relevant state or jurisdiction.

Approving or Rejecting Requests

-

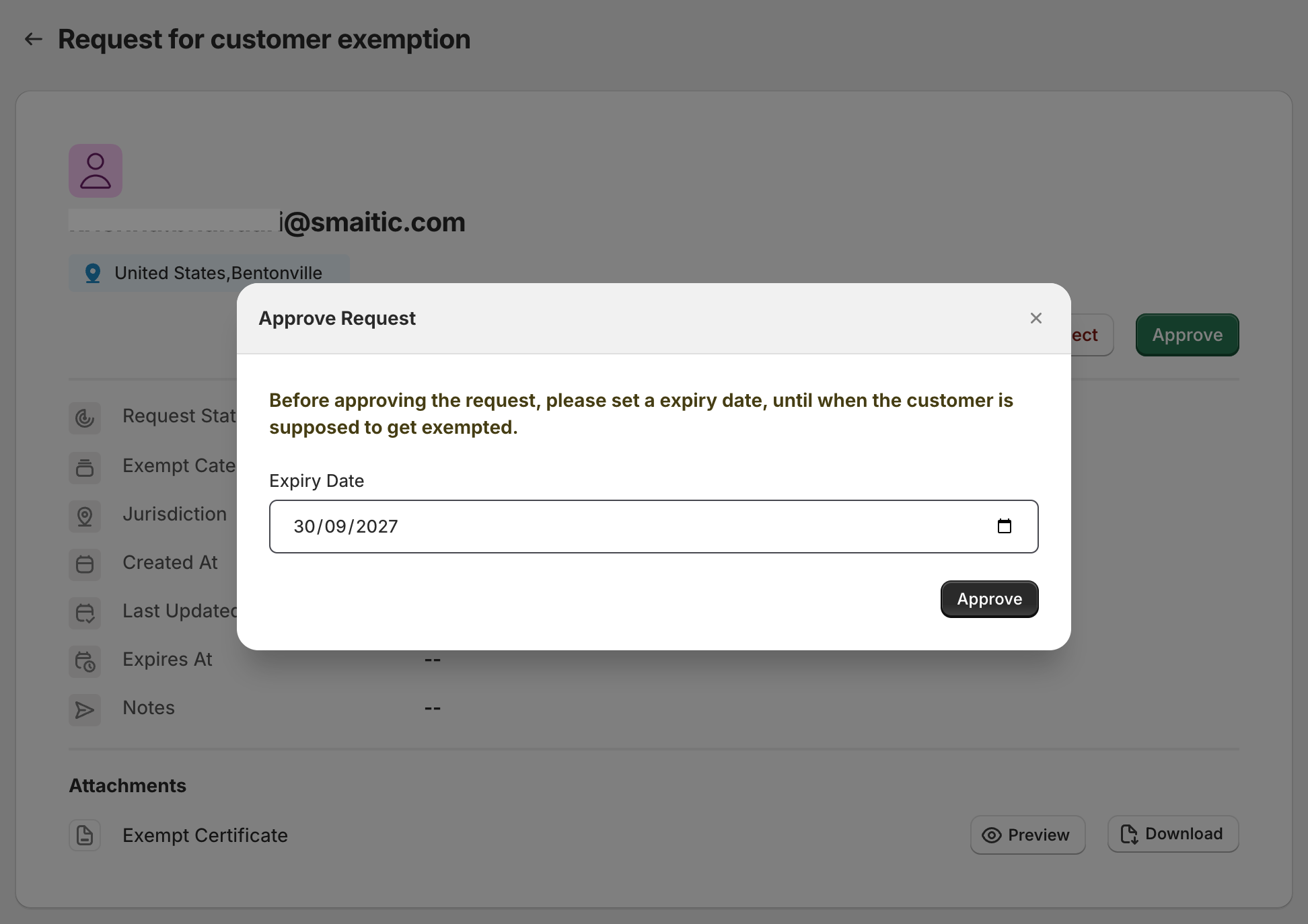

If the request and documentation are valid, click the "Approve" button. Enter the expiry date of the exemption before approving the request. The customer's tax-exempt status will be updated, and they will be notified via email.

-

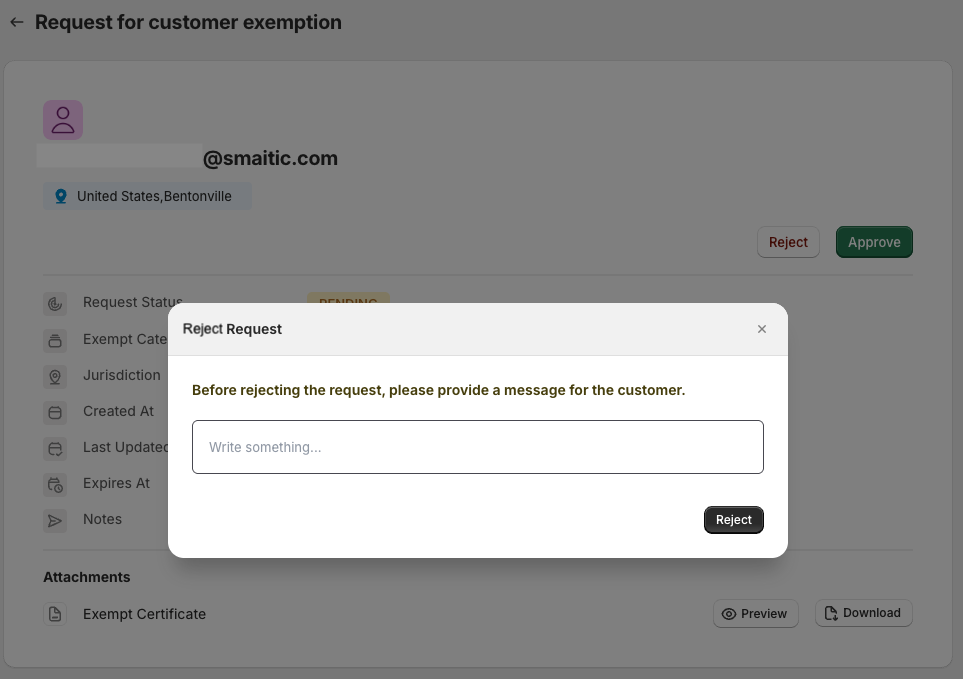

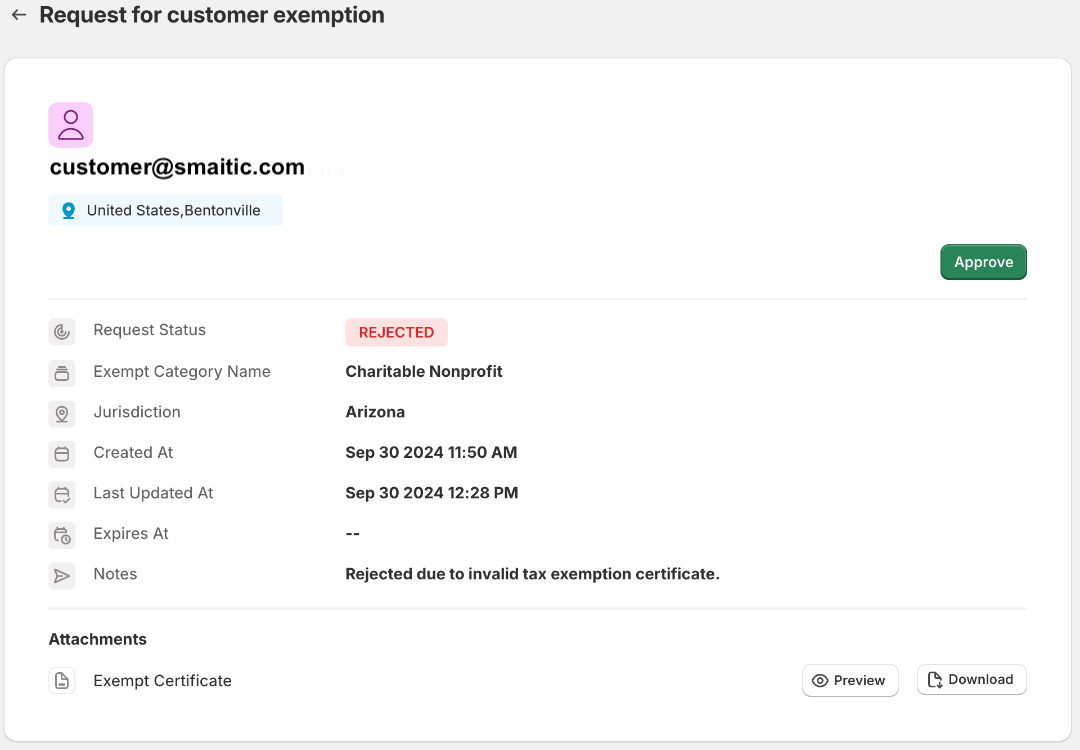

If the request and documentation are invalid or incomplete, click the "Reject" button. Provide a reason for the rejection and submit. The customer will be notified via email about the rejection and the reason.

-

The rejected tax exemption request from a customer can be approved again after re-assessing, if necessary.

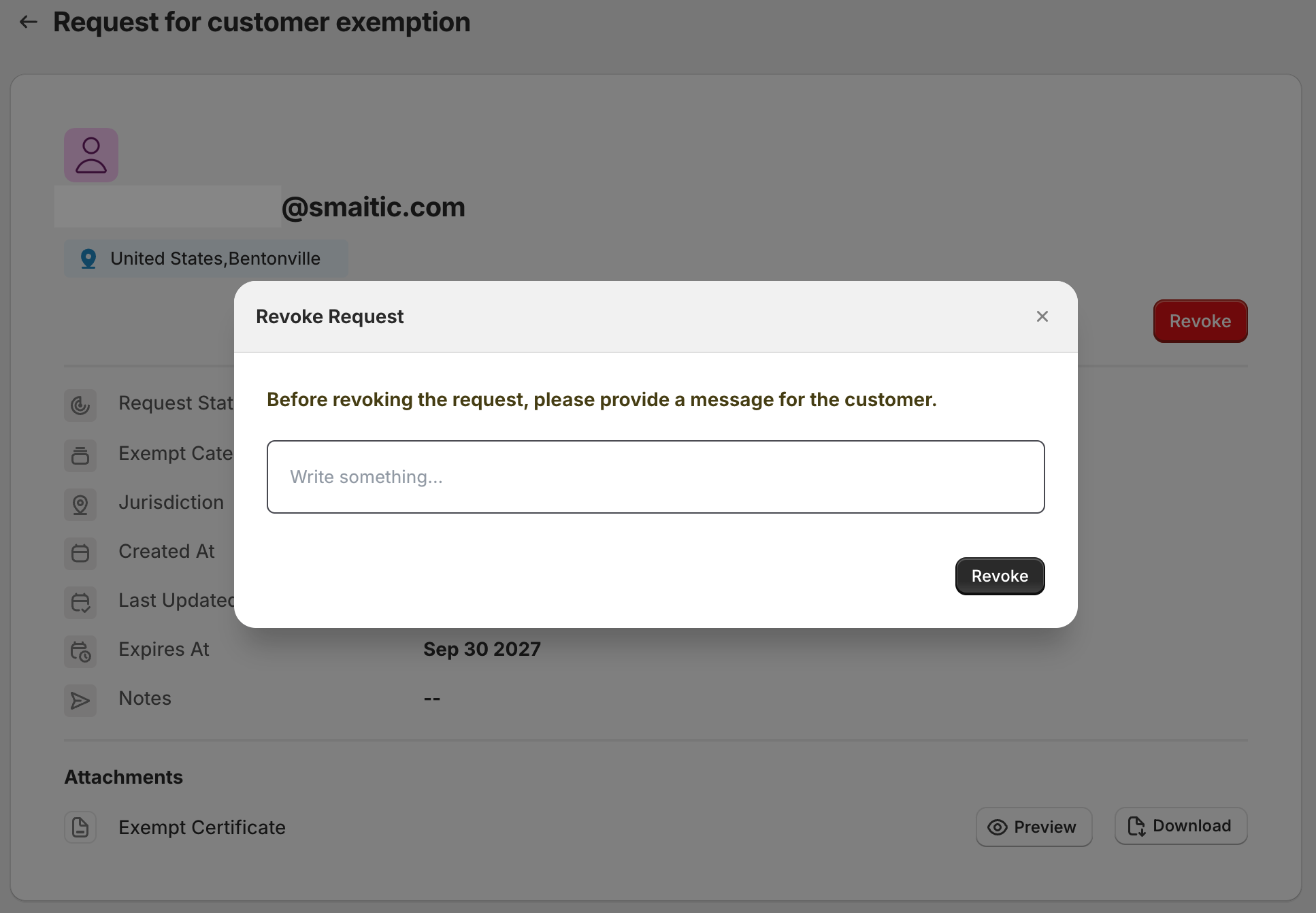

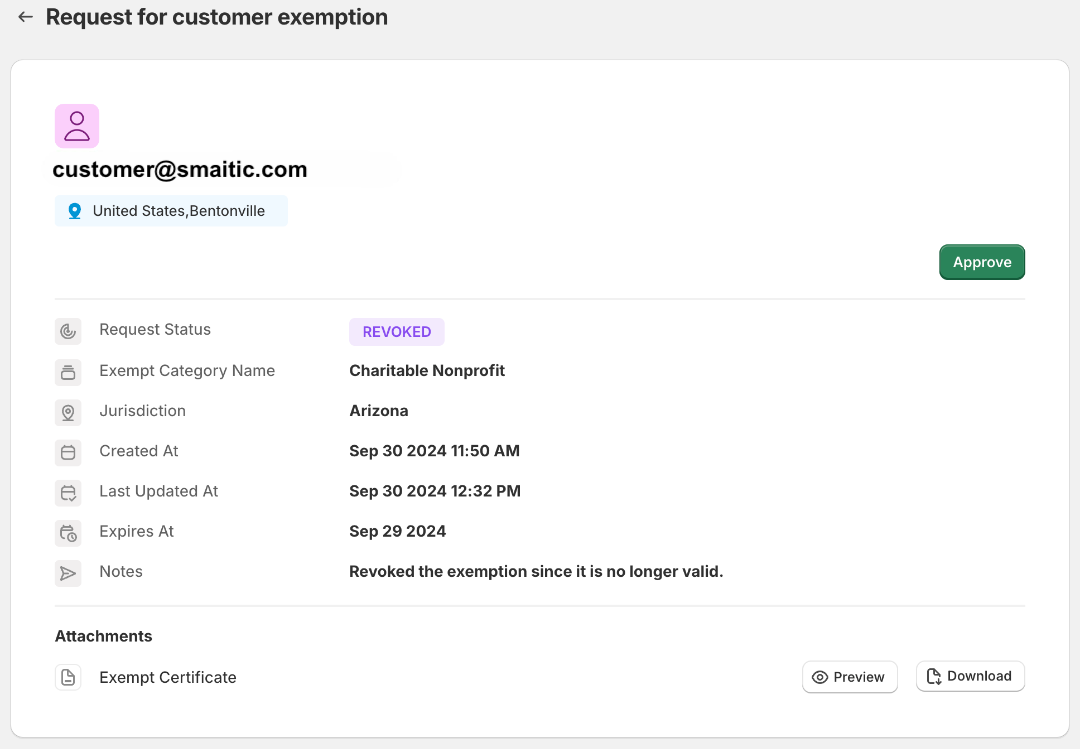

Revoking Exemptions

-

Navigate to the "Approved" section in the TaxWisp app dashboard. Find the approved request whose exemption you want to revoke, and click on the request to view the details.

-

Click the "Revoke" button next to the customer's name. Provide a reason for the revocation and submit. The customer's tax-exempt status will be updated accordingly, and will be notified via email about the revocation and the reason.

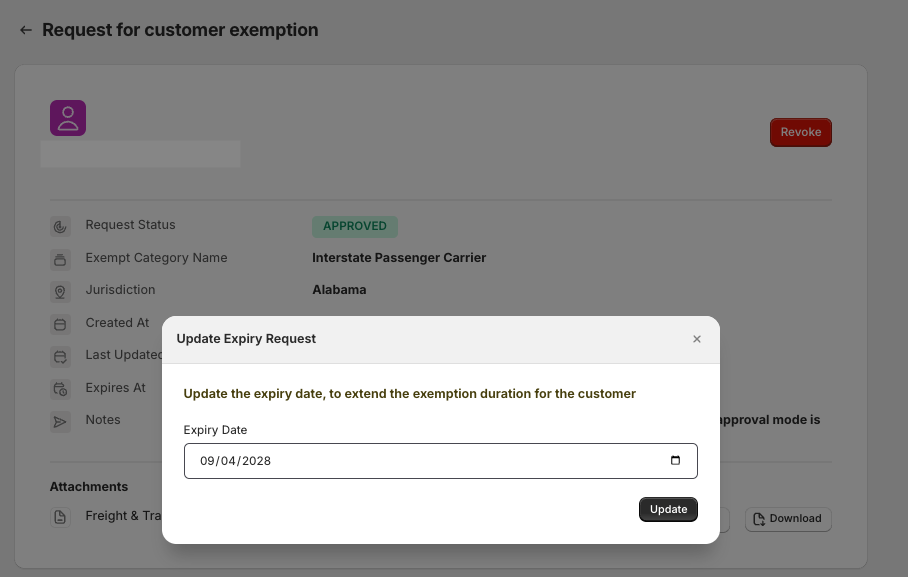

Modifying Expiry Date of Customer Tax Exemptions

To give store owners better control over exemption validity, TaxWisp now allows you to update the expiry date for already approved customer exemptions—especially useful when exemptions are about to expire.

To modify the expiry date, simply go to the Expiring Soon section in your TaxWisp dashboard and locate the customer exemption you'd like to update and navigate to the detailed page.

Click on the edit icon next to the current expiry date, and you’ll be able to select a new expiry date from the calendar. Once updated, the new expiry date will take effect immediately.

Approving previously Revoked Exemptions

-

The revoked tax exemption for a customer can be approved again after re-assessing, if necessary.

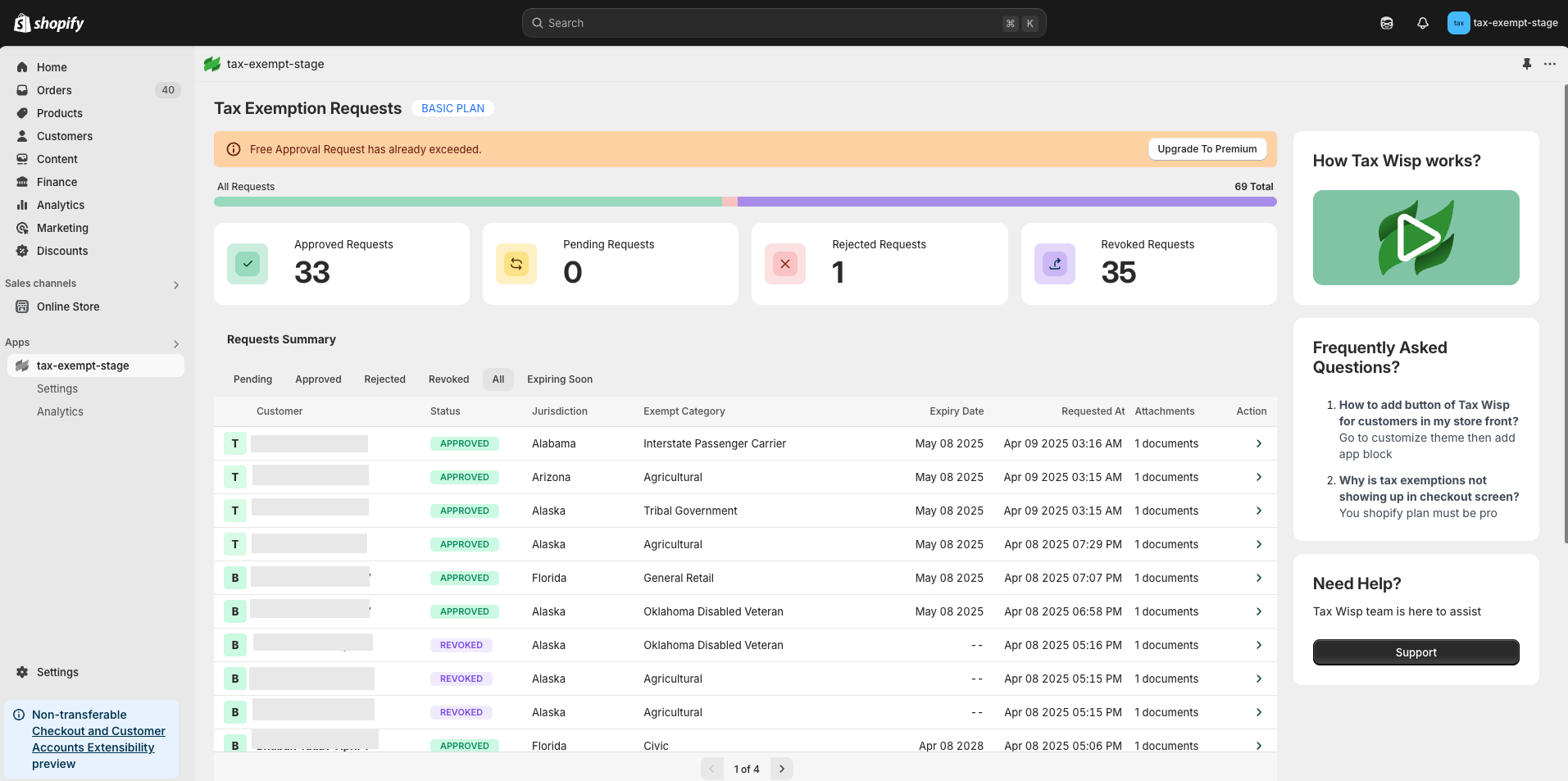

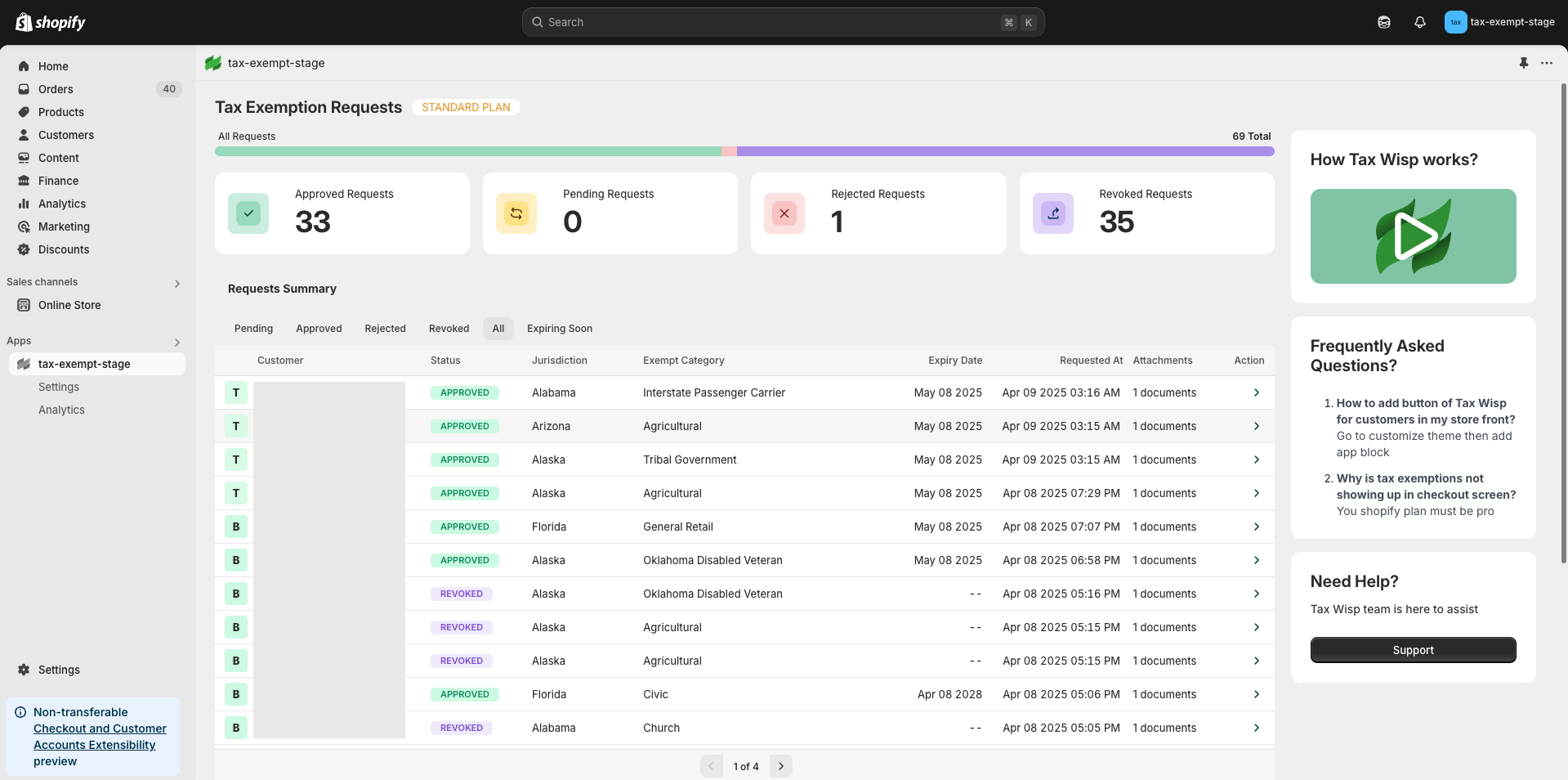

Tracking Tax Exemption Requests and Statuses

- In the TaxWisp dashboard, navigate to the "Requests Summary" table which has the list of all tax exemption cases. View all tax exemption requests and their current statuses (Pending, Approved, Rejected, Revoked, All and Expiring Soon).

- Click on any request to see detailed information, including submission date, status updates, and any actions taken.

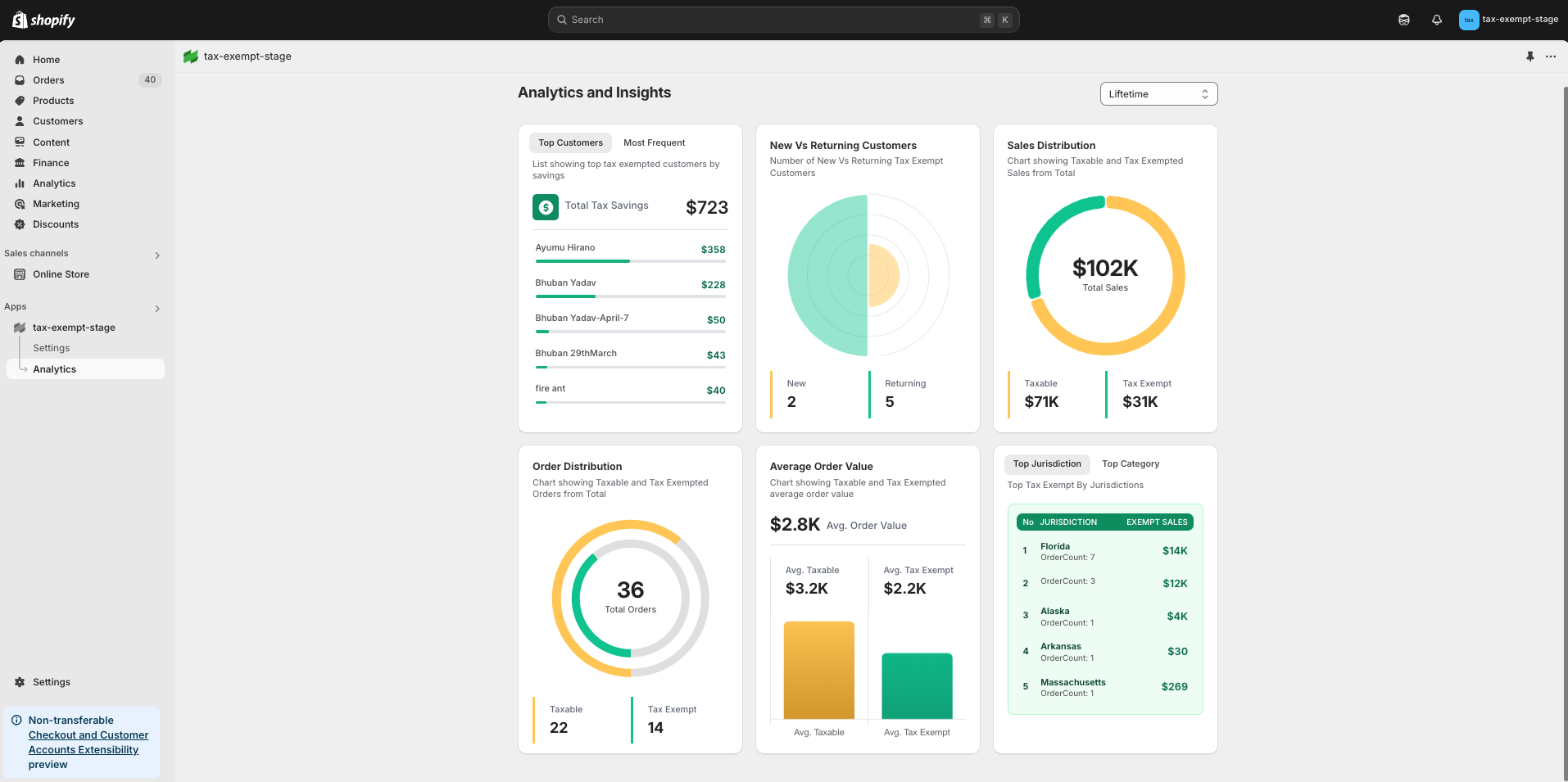

Analytics and Insights

The Analytics & Insights feature in TaxWisp is designed to provide data-driven visibility into how tax exemption activity impacts your store. Available exclusively to stores subscribed to a paid plan, this dashboard offers detailed, actionable metrics that can guide store owners in making smarter, more informed decisions.

Here's a clearer breakdown of the parameters, their usefulness, and how they add value to your store:

Top Tax-Exempt Customers

- What it shows: A ranked list of customers who have claimed the highest volume or value of tax exemptions.

- Why it's useful: Identifying your most valuable tax-exempt customers helps you prioritize relationships, offer targeted promotions, and ensure smooth exemption processes to keep them loyal.

Most Frequent Exemption Requestors

- What it shows: Customers who frequently submit exemption requests, regardless of order value.

- Why it's useful: Frequent requestors might indicate businesses or resellers. Understanding this can help tailor communications, streamline their experience, or introduce them to advanced features like auto-approval.

New vs. Returning Tax-Exempt Customers

- What it shows: A comparison of first-time exempt customers versus those returning for repeat tax-free purchases.

- Why it's useful: Helps you gauge customer retention and loyalty among tax-exempt shoppers. A growing base of returning customers may reflect satisfaction with the exemption process.

Taxable vs. Tax-Exempt Sales Distribution

- What it shows: A percentage and volume breakdown between sales that were taxed and those that were exempt.

- Why it's useful: Visualizing this helps stores measure the impact of exemption sales on overall revenue and forecast future demand more accurately.

Taxable vs. Tax-Exempt Order Distribution

- What it shows: Similar to the sales breakdown, this shows how many orders were fully or partially exempt from tax.

- Why it's useful: If a large number of orders are exempt, your operational processes must be optimized to handle certificates and compliance efficiently.

Average Order Value (AOV) - Taxable vs. Tax-Exempt

- What it shows: The average dollar value of orders placed with tax exemption compared to taxable ones.

- Why it's useful: Stores can use this to understand whether tax-exempt customers tend to place larger or smaller orders, which influences pricing strategies and marketing offers.

Top Tax Exemption Jurisdictions

- What it shows: U.S. states or tax jurisdictions where exemptions are most frequently claimed.

- Why it's useful: Helps ensure your compliance and processes are aligned with the most relevant regional laws. You can also identify sales trends and target those areas more effectively.

Top Tax Exemption Categories

- What it shows: The most commonly selected exemption categories during certificate submission (e.g., Resale, Nonprofit, Government, Agricultural, Manufacturing, etc.).

- Why it's useful: Helps you understand the reasons customers are claiming exemptions. This insight allows stores to streamline their document verification process for common categories, adjust their exemption handling policies accordingly, and even identify new customer segments (e.g., B2B resellers or nonprofit buyers) for targeted outreach or campaigns.

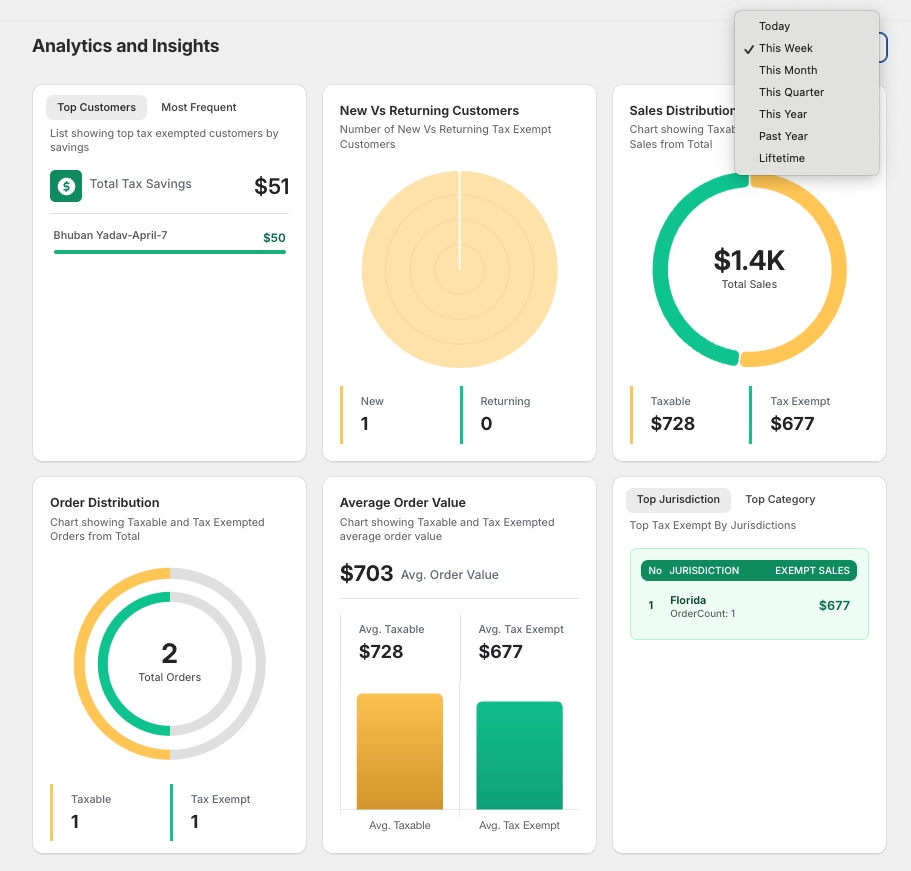

Date Range Filtering

- What it shows: Ability to filter all analytics over custom timeframes (e.g., Today, This Week, This Month, This Quarter, This Year, Past Year and Lifetime).

- Why it's useful: Enables you to track changes over time, spot seasonality trends, and evaluate the success of marketing campaigns or tax policy changes.

These insights give you a clear overview of how tax exemption affects your sales and customer behavior, enabling you to optimize your processes and marketing strategies accordingly.

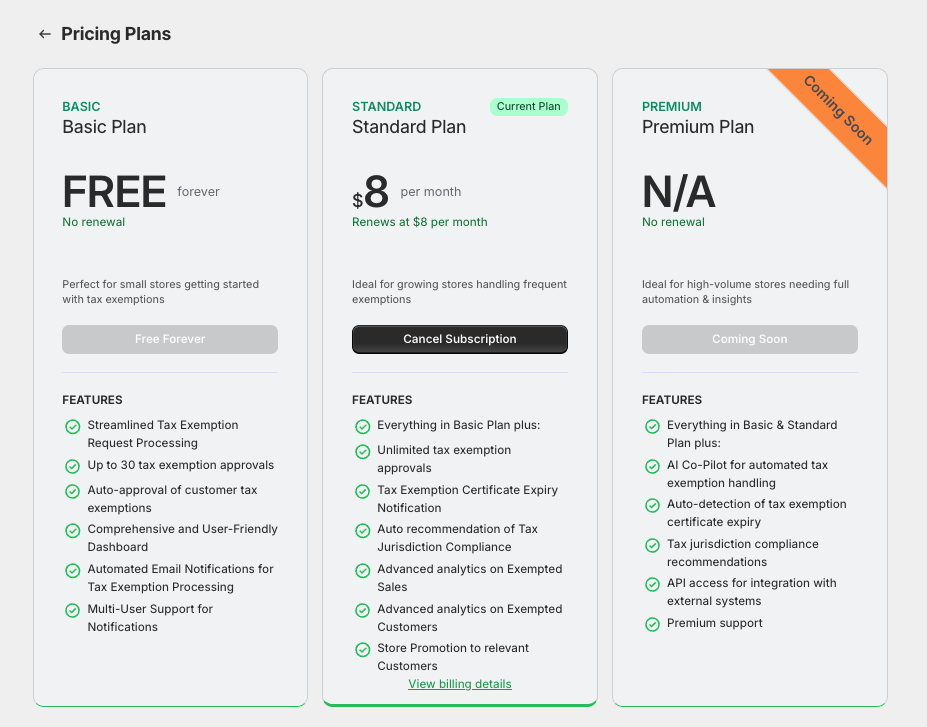

Subscription Plans

TaxWisp offers flexible subscription plans designed to suit stores of all sizes—whether you're just starting out or handling a high volume of tax-exempt customers. Each plan is built to automate and simplify your sales tax exemption process directly within your Shopify store.

Basic Plan

The Basic Plan is ideal for small or new stores getting started with tax exemption management. It only allows you to process only 30 tax exemption approvals.

Once you reach the quota of 30 approvals, you won't be able to accept and approve further customer tax exemption requests. You can upgrade to paid plan for higher exemption approval quota.

This plan helps stores streamline the manual process of collecting and managing exemption certificates without any cost.

Standard Plan

For growing stores with increasing exemption volume, the Standard Plan unlocks more automation and data insights. It allows you to process unlimited sales tax exemption approvals.

It also helps stores in certificate expiry tracking, and provides advanced analytics and insights on tax-exempt sales and customers. This plan is perfect for stores aiming to scale and make more data-driven decisions about their exempt sales activity.

Premium Plan (Upcoming)

The upcoming Premium Plan is designed for high-volume and enterprise-level stores. It will offer full automation, advanced compliance features, AI Co-Pilot for automated handling and system integration capabilities.

Additional Features

- Automated Notifications

- You will receive email notifications upon receiving tax exemption requests from customers.

- Certificate Expiry Tracking

- Stores subscribed to TaxWisp’s paid plans will benefit from extended certificate expiry tracking and timely notifications. This ensures that you're always aware of upcoming expirations, helping you stay compliant and proactively request updated certificates from your customers before they expire.

- Assistance and Support

- If you need assistance, contact the TaxWisp support team directly from the app or via email at support@taxwisp.ai.

When store owner uninstalls the TaxWisp app from the Shopify store, previously exempted customers will remain tax-exempt even after the app is uninstalled.

By following this configuration guide, you can tailor the TaxWisp Shopify App to optimize tax exemption processes and deliver a seamless experience for both, your store and your customers. If you encounter any challenges or need assistance during the configuration process, don't hesitate to reach out to our Support Team for help. We're here to ensure your success with our app.